How Much Damage are Trump's Solar Tariffs Doing to the U.S. Industry?

- Ajani Stella

- Sep 4, 2018

- 3 min read

Updated: Oct 23, 2018

6 months of solar tariffs. That's a lot. These tariffs are unfortunately having an impact on jobs and companies, but you would be surprised on how little the impact is.

The Tariffs

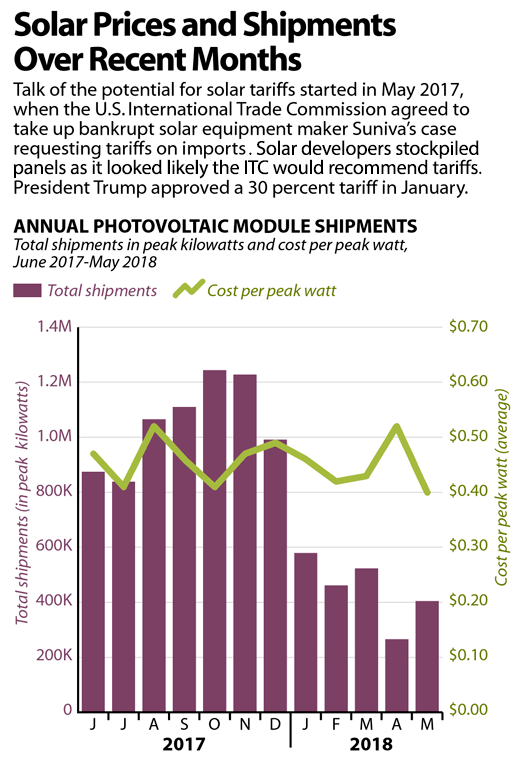

Trump signed into law these tariffs in January to take effect on February 2, 2018. It taxes the import of crystalline-silicon solar products, the most common material used for building solar panels, by 30%. That means that solar panels could be more expensive. That would mean increased solar panel prices, which could lead to less solar projects, which would lead to thousands of job losses.

The Impact

The tariffs, as outlined above, would cause a catastrophic impact to the solar industry. However, company executives say that they effects of the tariffs have been canceled out by other factors. Many developers had many cheap solar panels in store, anticipating the coming tariffs. China also helped the companies, slowing their domestic installation and creating a flow of cheap solar panels before the taxes. Also, U.S. consumers have a large incentive to buy solar panels within the next 18 months, before U.S. tax incentives start to fade away.

So far, there is not much date to tell us what impact the import fees are having on altering project costs, although it is clear that there has not been a dramatic change.

"We're really talking about small changes to a general trend," said Colin Smith, a solar analyst for Wood Mackenzie Power & Renewables. That general trend is the rapid growth of solar installations. "It does have an impact," he said. "But it's not terrible."

Company Reaction

Some companies have stated that they are opening or expanding plants inside the U.S. to avoid the tariff costs. However, any advantage they have for doing that will be short-lived because the tariffs, which started at 30%, go down each year until a complete phaseout after 4 years.

Panel buyers say that the effects on prices are brief and minor. Bob Komin, CFO for the rooftop solar company SunRun, says that equipment prices are falling back to last year, before the run-up to the tariffs. That means that they are getting more expensive than the run-up to the tariffs, but they are actually not getting more expensive than before.

"Generally speaking, I think any price increase arising from tariffs ought to be temporary"

he said, noting that major companies can adjust their production in response to the tariffs, which we have already seen China do.

The Current State of the Market

The U.S. solar market is still going strong. There has been an added 2.5 GW capacity in the first 3 months (first quarter) of 2018, a 13% increase from 2017 first quarter according to the Solar Energy Industries Association. This growth is helped by strong demand from corporations that have pledged to move towards clean energy.

Compared to the industries initial fears, "the tariffs have had less of an impact, and that is a good thing," said Amanda Levin, a policy analyst for the National Resources Defense Council.

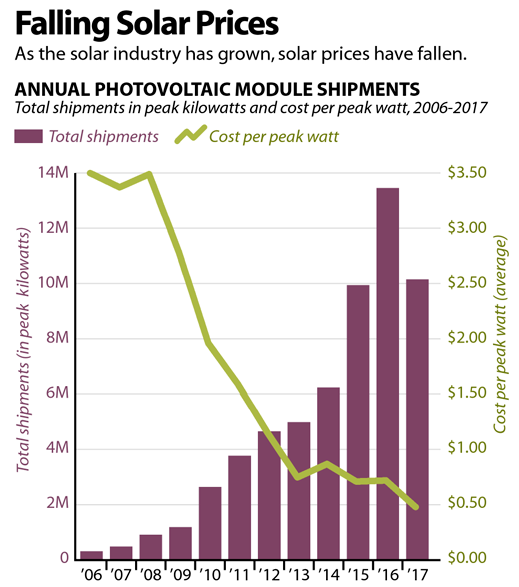

As the solar industry grows, the price drops. You can see the trend that solar prices go down as the amount of shipments goes up. Just 10 years ago, in 2008, the price was $3.50. Now, if you look at the graph below, that price has decreased by $3.10, or 88.57%.

The Solar Energy Industries Association (SEIA) estimates 9,000 job losses from the tariffs. That number includes laid off workers and prospective jobs that were unfilled. The group had woarned in Janurary that the job losses could be 23,000. Thankfully, that was incorrect.

Wood Mackenzie estimates that in the second quarter of the year, solar prices were around 40¢ per watt. That is the second consecutive quarter in falling prices. Those prices had a slight increase in 2017, but are going down now.

As you can see, the prices did change a lot over the past few months. However, we are are now on a steady decrease and are under 40¢.

Which Market is Being Affected the Most?

The utility-scale projects are the most affected because that is where is price is really important. However, in rooftop projects, the price can be absorbed with the price of parts

Please note that these numbers of capacity may seem small, but it is actually a large amount because that number is the amount of rooftop solar that can be produced at any given time, under full solar radiation. However, the average American home needs their solar system to have an approximate capacity of 0.55 KW. That means there were approximately 4,545,455 projects installed in the first quarter of 2018.

Image credit: InsideClimate News

Comments